Tuition and Fees

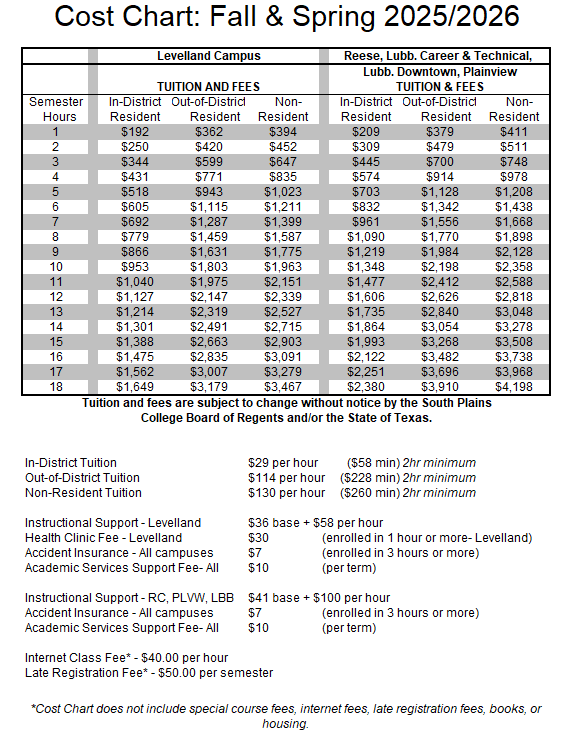

These tuition and fee tables are provided to assist students in estimating the cost of enrolling at South Plains College. The tables provide cost totals for each SPC campus location for in-district resident students, out-of-district resident students, and non-resident students. The cost figures presented in this table include tuition and applicable fees, including instructional support fee, student accident insurance, student health services fee and out-of-district fee. The table does not include special course or equipment fees charged for specific classes, books and supplies, or food and housing. Tables include tuition and fee estimates for fall and spring semesters only.

To see Financial Aid Cost of Attendance Click here

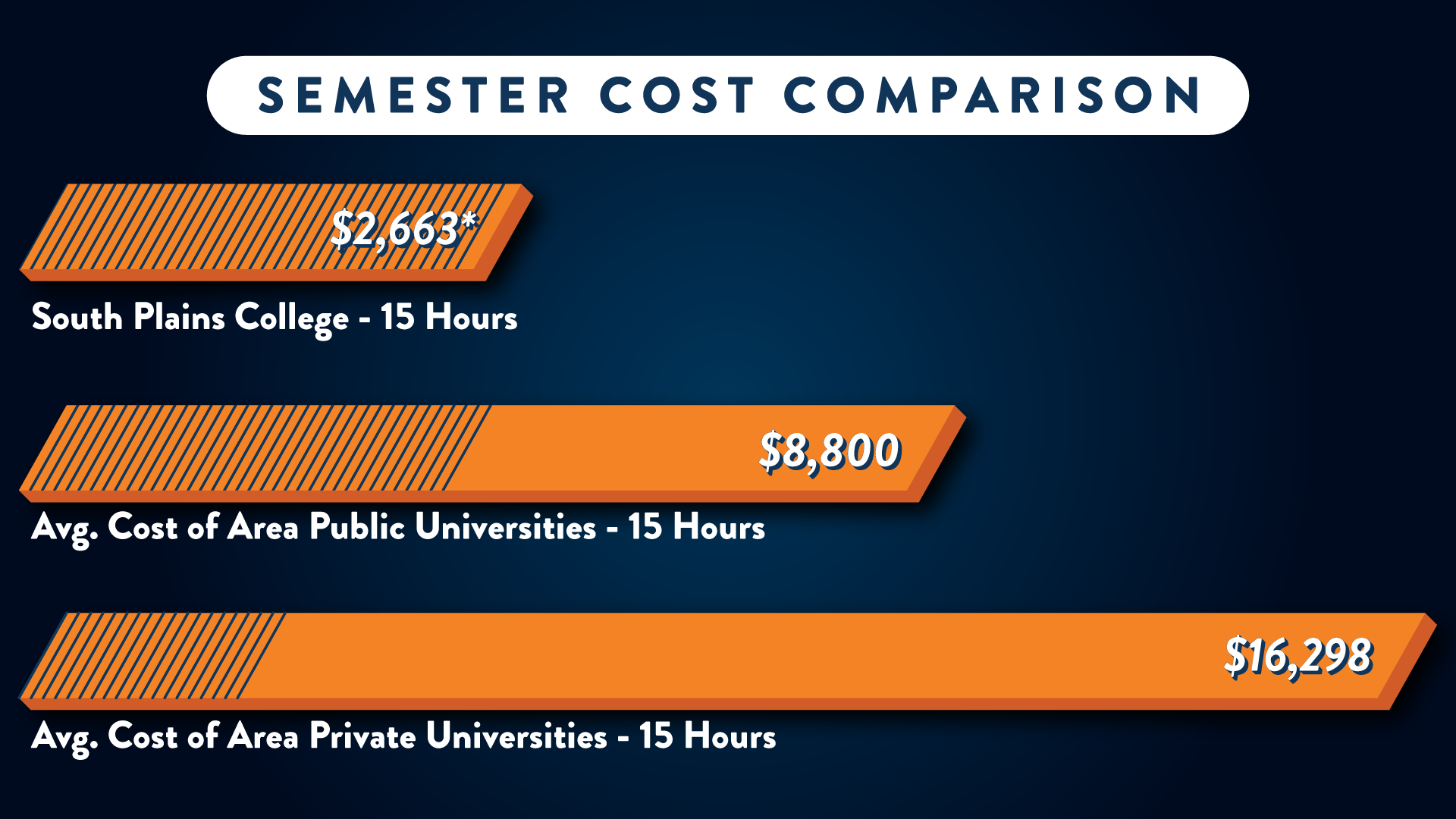

Download a printable cost comparison chart.

STUDENT RESIDENCY REQUIREMENTS

It is the responsibility of each student attending South Plains College to register under the proper residence classification and pay the correct tuition and fees. The Texas Higher Education Coordinating Board, Rule 21.38, requires that students sign an Oath of Residency at the time of application.

The South Plains College Board recognizes the authority of the Coordinating Board to set residency policy as authorized by the Texas Legislature and South Plains College will follow the guidelines as set forth by the Coordinating Board.

The residence classification of a student is determined by the student's LEGAL residence as defined by the statutes of the State of Texas. The following definitions explain and clarify questions concerning residence under the present law. Additional information, if needed, may be obtained from the Dean of Enrollment Services.

Texas Resident: An adult Texas resident (18 years of age and older) is defined as one who has resided continuously within the State of Texas for 12 months immediately prior to his/her original registration for purposes other than educational. A minor Texas resident is defined as one whose parent(s) or legal guardian has claimed the dependent for federal income tax purposes both at the time of enrollment and for the tax year preceding enrollment. This classification is defined by the State Auditor's Office and must be adhered to by this institution.

Non-Resident: A non-resident student is defined as one who does not qualify as a Texas resident (out-of-state, international). A non-resident classification is presumed to be correct so long as the student is in the state primarily for the purpose of attending school. To be reclassified as a resident, after one or more years of residency, the student must show proof of intent to establish Texas as his/her own residency. A student who owns property in the South Plains College District (Hockley County or Whiteface ISD) may be eligible for a waiver of out-of-state tuition. Students who believe they are eligible for such a waiver must contact the Dean of Enrollment Services.

In-District: A Texas resident who physically resides within the geographic boundaries of the South Plains College District (Hockley County or Whiteface ISD), excluding student housing or residence halls. To qualify for in-district tuition, a student must have been classified as a Texas resident and have been a resident of the South Plains College District for a period of six months before first enrollment. A student may re-classify from out-of-district to in-district status, with appropriate documentation, after physically residing in Hockley County or Whiteface ISD for six consecutive months with the intent to make South Plains College District one's permanent home and for purposes other than educational.

Out-of-District: A Texas resident who does not physically reside within the geographic boundaries of the South Plains College District (Hockley County or Whiteface ISD). Aliens living in the United States under a Visa permitting residence must meet the same requirements for qualifying for resident status for tuition purposes, as do U.S. citizens. A permanent resident must meet the same length of residency requirements as a citizen.